Why control the family budget?

Do yo know how to plan a family budget? The problem of lack of money is relevant for most modern families. Many literally dream of paying off their debts and starting a new financial life. In a crisis, the burden of low wages, loans, and debts affect almost all families without exception. That is why people strive to control their spending. The point of saving costs is not that people are greedy, but to find financial stability and look at your budget soberly and impartially.

The benefit of controlling the financial flow is obvious – it is cost reduction. The more you save, the more confidence in the future. The money saved can be used to form a financial cushion that will allow you to feel comfortable for a while, for example, if you are left without a job.

The main problem in way of financial control is laziness. People first light up with the idea of controlling the family budget, and then quickly cool down and lose interest in their finances.

To avoid this effect, you need to acquire a new habit – to constantly control your expenses. The most difficult period is the first month. Then the control becomes a habit, and you continue to act automatically. In addition, you will immediately see the fruits of your “labor” – your expenses will be surprisingly reduced. You will personally see that some expenses were superfluous and you can refuse them without harm to the family.

Accounting for family expenses and income in an Excel

If you are new to family budgeting, then before using powerful and paid home bookkeeping tools, try keeping a family budget in a simple Excel spreadsheet. The benefits of such a solution are obvious – you do not spend money on programs, and try your hand at controlling finances. On the other hand, if you bought the program, this will stimulate you – since you spent the money, then you need to keep records.

It is better to start compiling a family budget on a simple table in which everything is clear to you. Over time, you can complicate and supplement it.

The main principle of drawing up a financial plan is to break down expenses and incomes into different categories and keep records for each. As experience shows, you need to start with a small number of categories (10-15 will be enough). Here is a sample list of categories of expenses for preparing a family budget:

- Automobile

- Household needs

- Bad habits

- Hygiene and health

- Children

- Rent

- Credit/debts

- Clothing and cosmetics

- Trips (transport, taxi)

- Food

- Entertainment and gifts

- Communication (telephone, internet)

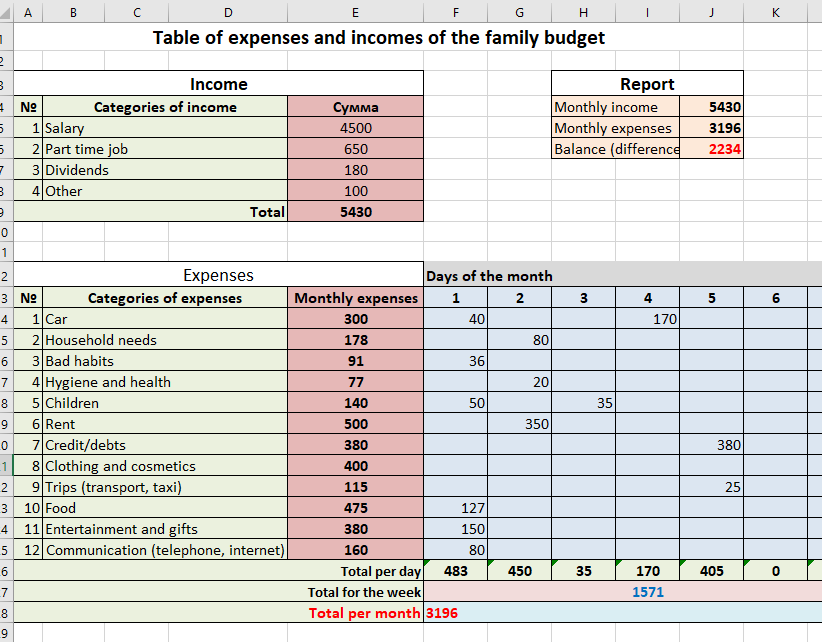

Consider the expenses and incomes of the family budget using this table as an example.

Here we see three sections: income, expenses, and report. In the “expenses” section, we have entered the above categories. Near each category is a cell containing the total expense for the month (the sum of all days on the right). In the “days of the month” area, daily expenses are entered. In fact, this is a complete monthly report on the expenses of your family budget. This table gives the following information: expenses for each day, for each week, for a month, as well as the total expenses for each category.

As for the formulas that are used in this table, they are very simple. For example, the total expense for the category “car” is calculated by the formula =SUM(F14:AJ14). That is, this is the sum for all days on line number 14. The amount of expenses per day is calculated as follows: = SUM (F14: F25) – all numbers in column F from the 14th to the 25th line are summed up.

The section “income” is arranged in a similar way. This table has categories of budget revenues and the amount that corresponds to them. In the “total” cell, the sum of all categories (=SUM(E5:E8)) is in column E from the 5th to the 8th row. The “report” section is even simpler. Here, information from cells E9 and F28 is duplicated. The balance (income minus expenses) is the difference between these cells.

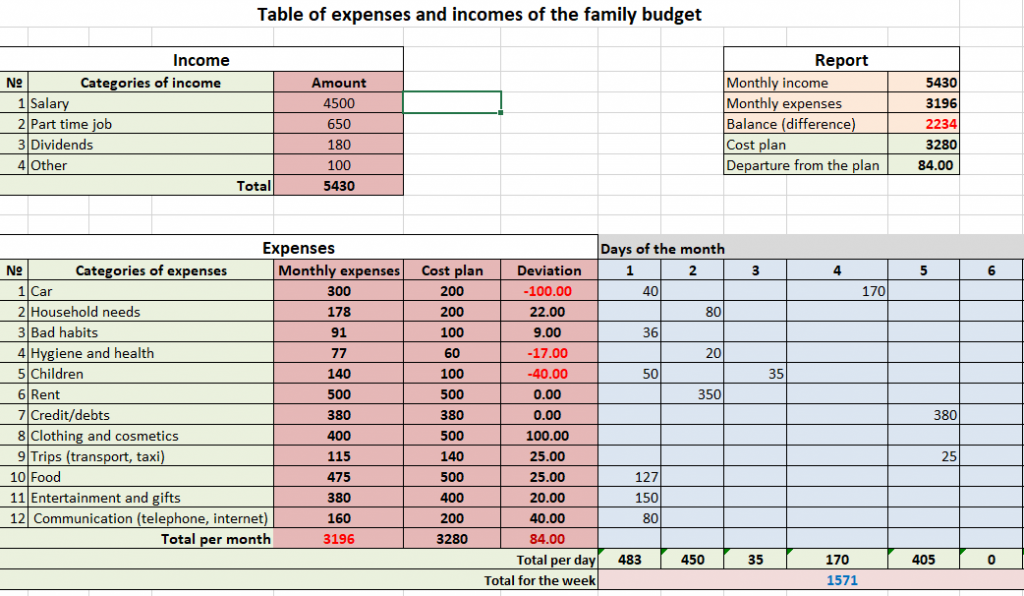

Now let’s complicate our expense table. Let’s introduce new columns “expenditure plan” and “deviation” (download the table of expenses and incomes). This is necessary for more accurate planning of the family budget. For example, you know that the cost of a car is usually 300 USD / month, and the rent is 500 USD / month. If we know the costs in advance, then we can make a budget for a month or even a year.

Knowing your monthly expenses and income, you can plan large purchases. For example, family income is 5430 USD / month, and expenses are 3 196 USD / month. This means that every month you can save 2 234 USD. And in a year you will be the owner of a large amount – 26 808 USD.

Thus, the columns “expenditure plan” and “variance” are needed for long-term budget planning. If the value in the “deviation” column is negative (highlighted in red), then you deviated from the plan. The variance is calculated using the formula =F14-E14 (that is, the difference between the plan and the actual costs for the category).

What if you deviate from the plan in any month? If the deviation is insignificant, then next month you should try to save on this category. For example, in our table in the category “Children” there is a deviation of -40 USD. This means that next month it is advisable to spend 60USD (100 – 40) on this group of goods. Then, on average, for two months you will not have a deviation from the plan.

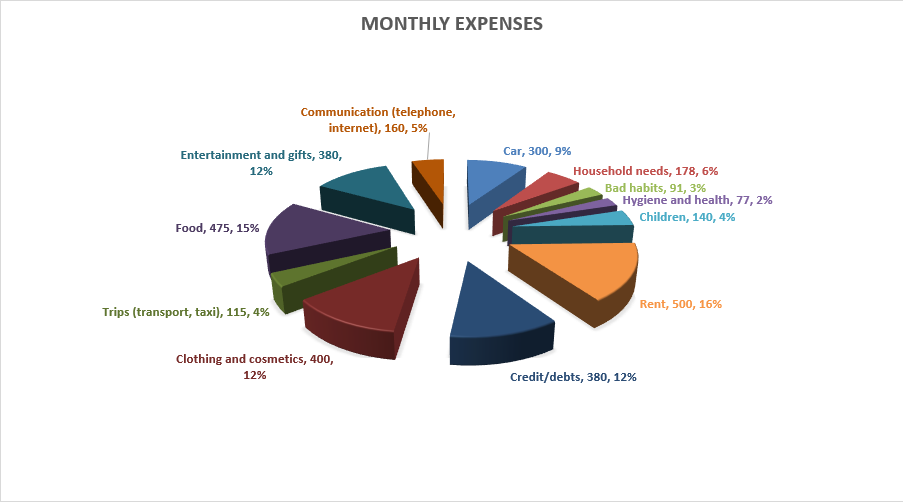

Using our data from the expense table, we will build a cost report in the form of a chart.

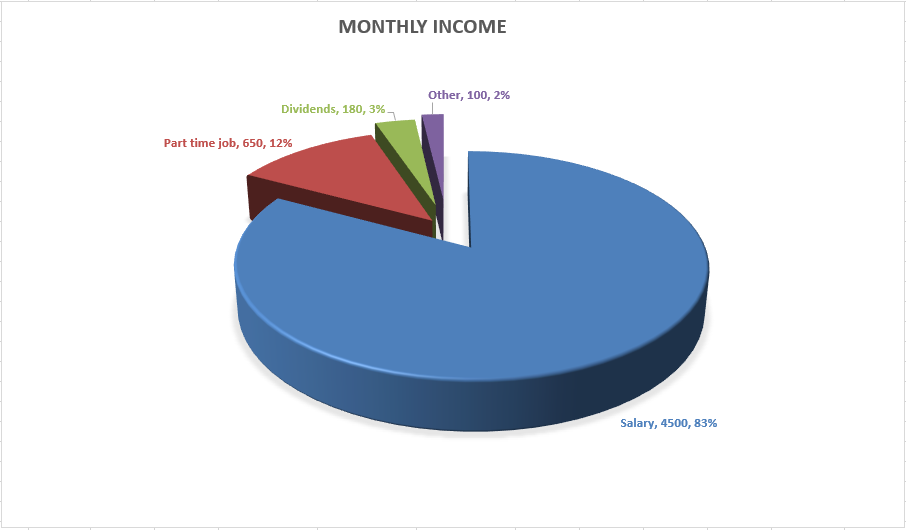

Similarly, we build a report on the income of the family budget.

The benefits of these reports are clear. Firstly, we get a visual representation of the budget, and secondly, we can track the percentage share of each category. In our case, the most expensive items are “clothes and cosmetics” (19%), “food” (15%), and “credit” (15%).

Excel has ready-made templates that allow you to create the necessary tables in two clicks. If you go to the “File” menu and select the “Create” item, the program will prompt you to create a finished project based on the existing templates. Our theme includes the following templates: Sample Family Budget, Family Budget (Monthly), Simple Spending Budget, Personal Budget, Half Monthly Home Budget, Monthly Student Budget, and Personal Expenses Calculator.