A few years ago, Apple (AAPL) and Amazon (AMZN) were among the most popular stocks on the NASDAQ market. Each is a massively successful consumer technology company. Both Amazon and Apple have more than 200 million customers on their Prime subscriptions.

However, it is not enough for a company to be popular with customers to be a smart investment. For today’s long-term investors, let’s match the e-commerce store against the smartphone pioneer.

The case for Amazon

In spite of the fact that Amazon is most recognized for its e-commerce industry, the company has a plethora of other revenue streams. As a result, the company’s Amazon Web Services business brought in the whole company’s operating profits in its most recent quarter, which concluded on March 31.

Revenue from Amazon’s subscription services, which include Prime membership fees, increased by 13% to $8.4 billion in the most recent quarter. In addition, Amazon’s advertising unit generated $7.9 billion in Q1, a year-over-year increase of 25 percent.

Considering that e-commerce sales have slowed since the pandemic-related increase, these various sources of revenue are essential.

In the last quarter, Amazon actually lost money in online sales, proving that e-commerce sales are a low-profit industry. Shipping is a significant expense. Members of Amazon’s Prime service, which costs an annual subscription, receive fast and free shipping, while non-members can obtain free shipping on orders over $25.

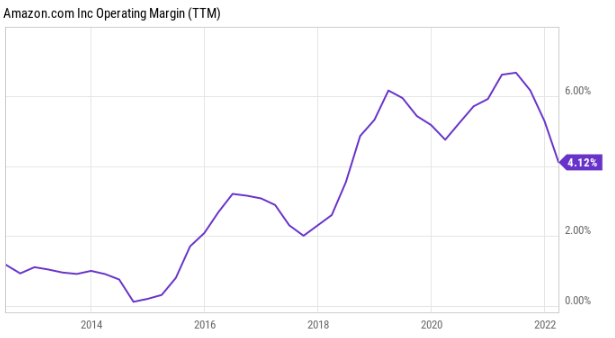

Despite its fast growth in sales, Amazon has been able to maintain a steady operating profit margin because of these forces. Recent growth in the more profitable categories has resulted in a rise in this indicator.

The case for Apple

The iPhone is Apple’s best-known product. During the six-month period ending March 26, Apple sold $122.2 billion worth of iPhones, accounting for 55% of all sales. But Apple has built a strong services sector, too, much like Amazon.

Sales of Apple’s services reached $39.3 billion in the same six-month period, up 20 percent year over year and accounting for around 18 percent of overall sales. Only a 7.6 percent increase in iPhone sales was recorded.

All of Apple’s services may be found through the App Store, including Apple Music and iCloud Drive. Apple’s services business, like Amazon’s, produces a larger profit margin. As of March 31, Apple’s service gross margin was 72.6 percent, while its product gross margin was 36.4 percent.

Customers are willing to spend money on Apple items because of the company’s long history of innovation. More recently, it has shown that it can expand its offerings to include new services with higher profit margins. As of March 26, the company announced that it had 825 million paying users, an increase of 165 million over the previous year.

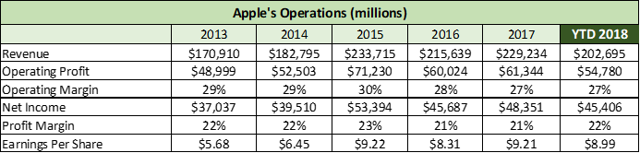

As a result, Apple’s gross profit margin has risen from 37.8 percent in 2019 to 41.8 percent in 2021, an increase of more than 10 percentage points.

Apple Vs Amazon – Fundamental Analysis of Stock Investing

Operating Performance

While Amazon’s sales are increasing quicker, I believe Apple is the better performer due to the speed at which their money is converted into actual earnings.

Apple’s revenue has climbed by 15% so far this year, and the company is on track for a record year in every major operating statistic. With operating and profit margins of less than 5%, I believe Amazon’s performance still falls a bit flat in my perspective.

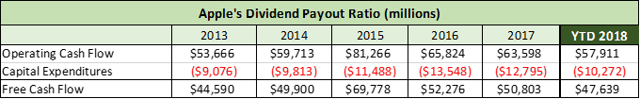

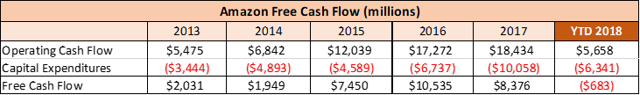

Free Cash Flow

Apple and Amazon’s free cash flow is the most important item to keep an eye on. When it comes to free cash flow, no one beats Apple, which has been using it to support a large share repurchase plan. So far this year, Americans have spent $53.3 billion. Amazon’s market value is nearly as high as Apple’s, but its free cash flow is only a quarter of Apple’s.

Amazon, like its operating performance, has failed to generate considerable free cash flow from its enormous revenue. I believe Amazon has what it takes to catch up to Apple, but how long will it take? A decade from now, it may be a completely different company, and I don’t think it’s worth risking your money on it.

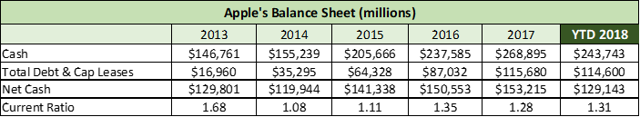

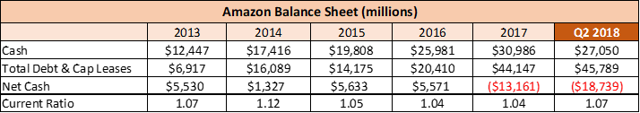

Balance Sheet

Apple has a net cash position of $129 billion, making it the most cash-rich company in the world. In terms of investment and acquisition possibilities, no other corporation can equal this quantity of capital.

Some of the factors I’ve already mentioned have contributed to Amazon having a negative net cash balance recently (e.g. no meaningful profits yet). Even if its debt-to-equity ratio is currently low, this is something to keep an eye on.

Valuation

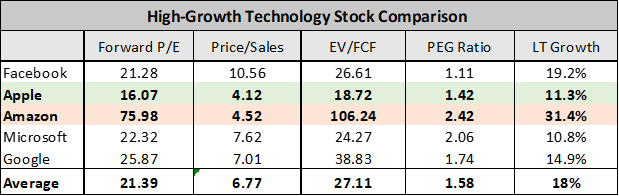

Apple’s stock price is based on solid fundamentals and appears to be a good investment. Apple’s 18.7x EV/FCF ratio and a growth rate of over 10% really appeal to me.

In contrast, Amazon’s value might be difficult to understand from a basic standpoint. When compared to other companies with 4% profit margins this year, Amazon’s price-to-sales ratio of 4.52x is out of this world.

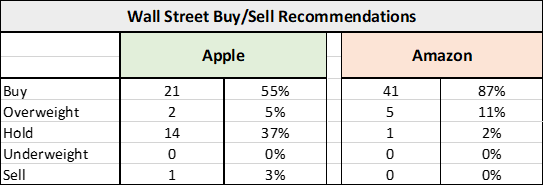

Wall Street’s Opinion

Amazon has far more support from Wall Street than Apple does. For investors, the average target price suggests more potential for growth than the majority of experts propose.

Shares of Apple are now trading at $219, while MarketWatch reports that the average target price is $214, which signifies a 2% drop in value. The current share price of Amazon is $1,936, and the average price goal for the stock is $2,127, representing a 10% increase.

Risk Profile

For a long time, I’ve argued that if Amazon’s value returns to historical norms, there will be a significant danger. Increases in price/sales multiples have been a major factor in the stock price’s recent gains, which have jumped from 1.78x to 4.52x in the past several years.

Its price/sales ratio is 0.55x, compared to Walmart’s (WMT) 0.55x. Given Apple’s current price/sales, forecast earnings, and EV/FCF, this risk does not apply to its shares.

Should You Buy Apple Shares Now or Wait for Some Time?

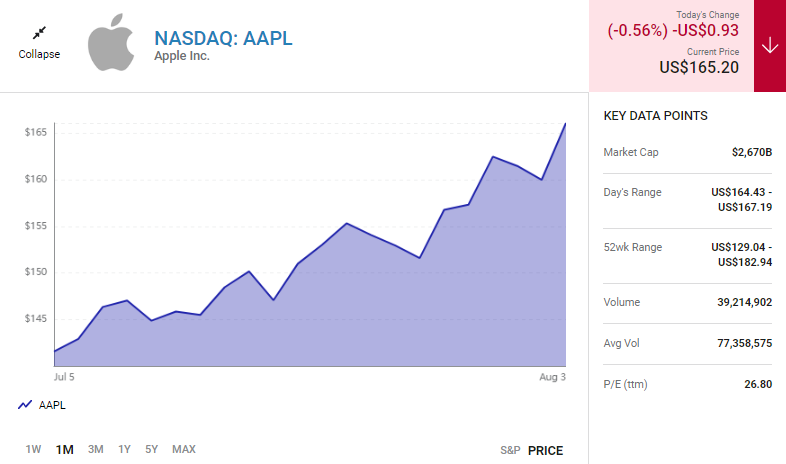

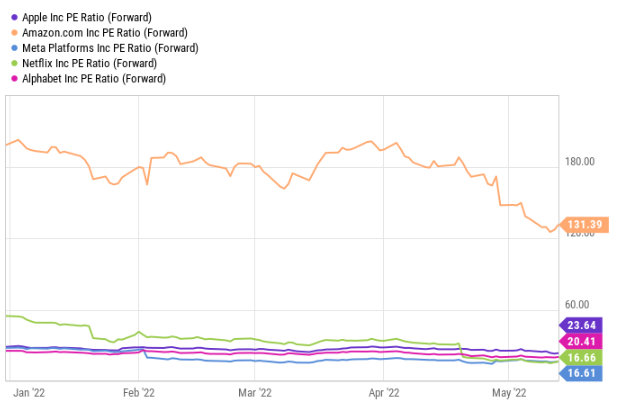

A combination of historically high inflation, increasing interest rates, and anxiety over the escalating conflict in Ukraine and Russia has caused many investors to sell their holdings recently.

Even big tech, which seemed unstoppable until recently, has been humbled. Meta Platforms (aka Facebook), Amazon, Apple (AAPL), Netflix (NFLX), and Alphabet are the FAANG stocks. A six-month investment in these five leading U.S. technology equities would have lost 40% of its value if held in an equal-weighted portfolio.

As of this writing, the only FAANG stock that hasn’t had significant price drops is Apple. For sure, Apple is one of the most recognized corporations in the world.

After 10 years, the stock has returned over 775 percent (including dividends reinvested), which works out to around 24 percent per year, compared to the S&P 500’s 268 percent return over the same period.

Investors, on the other hand, should not rush to buy shares in the IT company just yet. Because of its slowing growth and subpar value, this company is a better purchase right now.

The existing financial and market value of the firm should be examined in order to provide investors with a clearer image of the company’s future prospects.

Slowing growth

Apple’s growth is inevitably slowing due to the company’s enormous size. That’s because it has a $2.3 trillion market value, which is about 11 percent of the US GDP in 2020, and is almost as big as the UK’s.

Shareholders received $1.52 in profits per share (EPS) for the three months ending September 30, surpassing expectations by 4 percent and 6 percent, respectively. All of Apple’s product categories except the iPad saw growth, while the company’s services division surged 17 percent to an all-time high of $19.8 billion in sales.

As a result, Apple’s services division acts as a stimulus for future development despite the long-term durability of its iPhone, iPad, and Mac product lines

Analysts expect sales to rise by 8% from FY 2021 levels to $394.2 billion in the fiscal year 2022, and earnings per share to rise by 10% to $6.15.

Growth is predicted to slow down in the near future. An average annual growth rate of 5% is projected for Apple’s top line of $460.2 billion in fiscal 2025, according to Wall Street analysts. There are forecasts of a 6% yearly increase in earnings throughout this timeframe.

Short-term COVID outbreaks in China might lead to supply chain concerns, which would put an impact on sales for the rest of 2022, CEO Tim Cook warned investors. The Law of huge numbers is not to Apple’s advantage over the long term. The company’s primary business will not grow at the rate it once did unless it extends into other markets.

Be patient with Apple

While other large tech businesses are faltering, investors should pay attention to Apple’s ability to bounce back. This firm is well-positioned to grow into new markets, thanks in part to the safety and security of its main business.

There has been a gradual improvement in Apple’s value. Investors should not hesitate to buy shares of this world-class tech business when its price-to-earnings multiple falls below historical averages.

Should You Buy Amazon Now or Wait for Some Time?

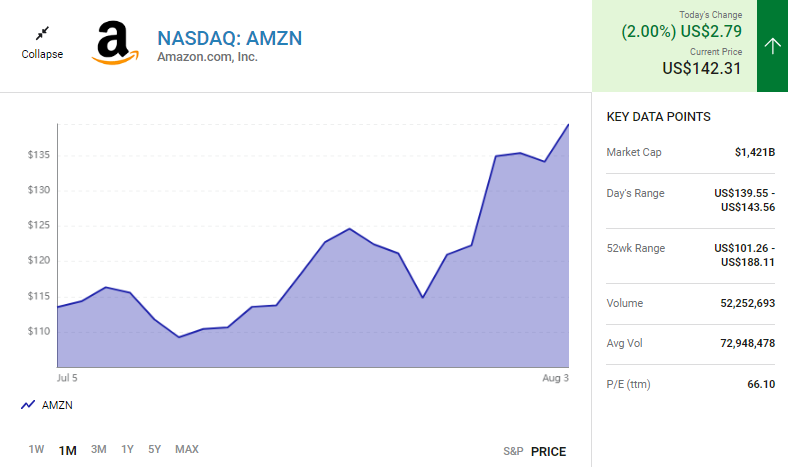

Investors in Amazon.com (AMZN) have had a difficult time recently. As of this writing, the stock is down 35% for the year and 43% off its all-time highs. As interest rates rose at the start of this year, high-growth technology equities took a big hit in their value proposition.

Inflationary pressures on retail sales were confirmed this week when Walmart and Target reported disappointing profitability. Amazon’s stock price plummeted as a result of its dominance in both of these industries.

Is it currently a good time to invest while others are afraid of a stock split and the firm is repurchasing stock?

Today’s challenges in the retail sector

In its first-quarter earnings report in April, Amazon predicted the retail devastation that occurred last week. Growth in total revenues slowed from 44% to only 7%, even as cloud use continued to rise.

Over the last year, the company’s operating profits actually decreased from $8.7 billion to $3.7 billion. Amazon’s North American and foreign retail divisions incurred a combined operating loss of $3.8 billion when Amazon Web Services (AWS) was excluded.

Be aware that this includes high-profit items like advertising and Prime memberships, which may have worsened Amazon’s bottom line.

Amazon’s revenue growth slowed as a result of the reopening of the economy, as Walmart and Target have acknowledged. Fuel prices, on the other hand, pushed up freight and logistics expenses significantly. When Amazon’s e-commerce business stalled, it had more capacity and staff than it required because of the pandemic’s rapid expansion.

To make matters worse, management expects growth of 3% to 7% for the following quarter and operating income of $1.0 billion to $3.0 billion to get even worse, respectively.

It’s a good buy now

Amazon’s shares will be divided on June 3, which is just a few days away. Stock splits normally pique the interest of ordinary investors, but that hasn’t been the case in this particular case study. During a major recession in the US, Amazon’s stock might drop.

Even if the worst-case scenario were to occur, today’s market looks to have a lot of negative news built-in.

Cloud computing alone may be a solid investment, but I expect the retail company to grow throughout the third quarter and the Christmas shopping season, potentially as early as Prime Day in the third quarter.

Conclusion

When compared to Amazon, Apple has a number of advantages that make it more appealing to us.

Every large valuation multiple results in a lower price for Apple. A reduced EV/FCF and PEG ratio in particular are persuasive arguments in favor of this approach.

As a result of Apple’s increased free cash flow, it has been able to build a financial war chest, support a dividend, and repurchase stock in the company.