REIT stands for Real Estate Investment Trust and this month I would like to buy some of these funds. And my eyes fell on two well-known funds Realty Income and Iron Mountain. Both of these funds have existed for a very long time and have managed to prove their value. One of the main reasons why I chose to buy funds this month is that they pay dividends, and even not bad dividends, they will help increase the monthly flow of money. But about all this a little later.

So, a little about Realty Income. It is a real estate investment fund in the US, Puerto Rico, and the UK. Often these are buildings with one tenant, who bears the main costs of insurance and maintenance of the property he leases, as well as paying taxes for it. The company is one of the few real estate investment funds that pay dividends on a monthly basis, not quarterly! It seems to me that this is ideal for monthly inflows. At the end of the third quarter of 2021, he owns 7,014 properties. The business company is based on the fact that it buys commercial properties and publishes them for long-term lease mainly to shops. Among the tenants, there are companies such as 7-Eleven, Walmart, Walgreen pharmacies. The fund has existed for 52 years; since 1994, the number of objects on the stock exchange has tripled.

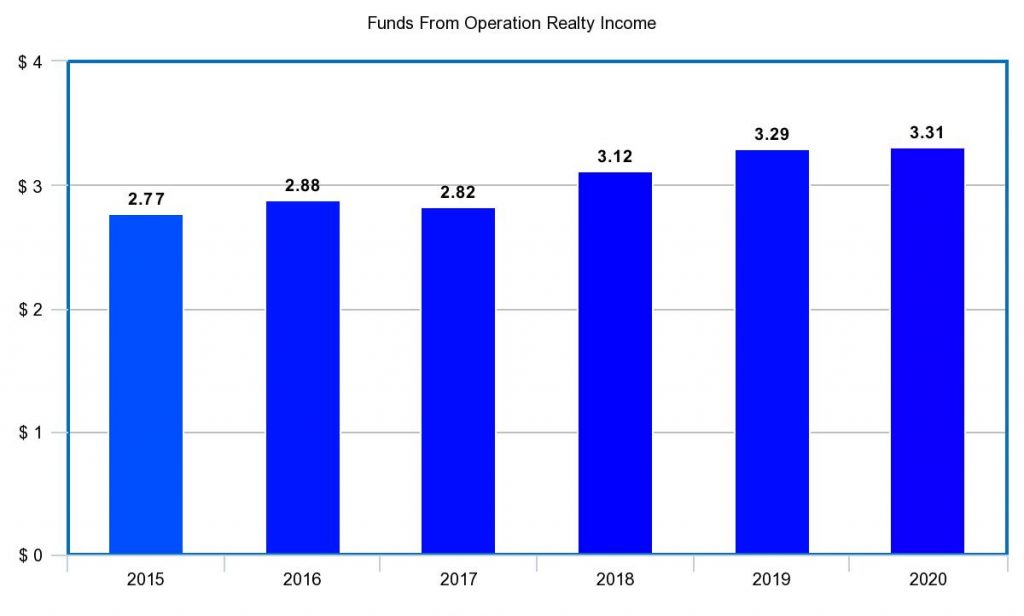

Over the past few years, cash flows have been growing and growing annually with the exception of 2020, because during the pandemic many shops and offices were closed. But at the same time, the main clients of the fund are supermarkets, which, even in times of coronavirus, is a very good anti-crisis solution. Since they continued to work even during the times of hard lockdowns. The fund’s profit of course for 2020 fell by only 10%. For December 2021, the dividend payment is 4.2% I will remind you what business performance indicator is the Funds From Operations per share (FFO) value. When analyzing REIT, first of all, we should look at this indicator. It reflects the amount of cash flows that the company generates in the course of its activities.

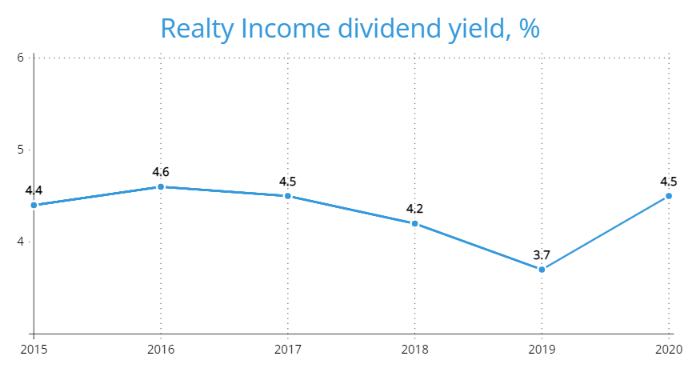

Real estate investment funds, in general, are always attractive for their fairly high dividend payments. Let’s look at the dividend payment over the past 5 years, the average Realty Income paid 4.2% per annum. RI pays dividends on a monthly basis, which will have a positive effect on the overall flow of money for further investments

In my opinion, now it is a very good time to buy several REITs. Of course, I understand that we have fears of new lockdowns, but in my opinion, a supermarket is better than cinemas and entertainment centers, and in the current situation we have little, but a guarantee that if they collapse, then not very much.

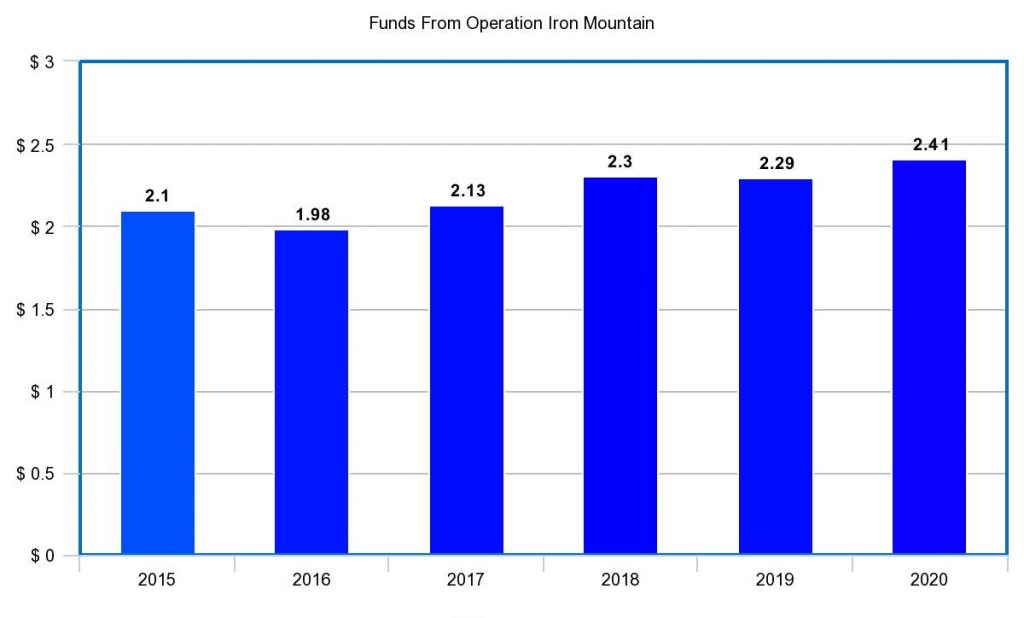

Now it’s the turn of Iron Mountain. It is a fund that specializes in providing secure storage of data such as documents, but also owns data centers and cloud services. IM is a component of the S&P 500 Index and a member of the FTSE4Good index. Its records management, information destruction, and data backup and recovery services are supplied to more than 220,000 customers. in 58 countries throughout North America, Europe, Latin America, Africa, Asia, and Australia. As of 2020, over 95% of Fortune 1000 companies use Iron Mountain’s services to store and manage their information. Also among the tenants are Google Cloud and Amazon Services, the largest cloud companies. Summing up, I would like to note that over the past few years, both companies have shown significant growth and development in their field, the last two difficult years have become no exception. Therefore, I believe that this purchase will be appropriate and we should not see drawdowns in the near future.

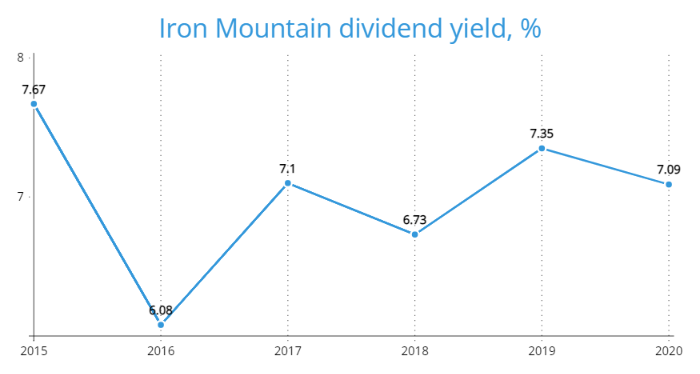

Iron Mountain dividend yield is about half that and has averaged 7% over the past five years

P.S. This month I could not ignore Virgin Galactic, as in my opinion it has reached a very important level, so I bought 3 shares of SPCE with the money that I have left from buying rates. I bought them at a price of 14.78 at the time of writing this post, their price was 16.44. Yes, I certainly understand, but most likely the price will be released even lower, but at the moment this is a good level to buy a little.